Stock Market & Crises: Why a Shift in Perspective is Crucial

The stock market is a place of extremes. Euphoria and panic alternate, gains and losses go hand in hand. Anyone investing for the long term will experience periods where everything seems to be going downhill. But it is precisely in these moments that the difference is made between those who remain successful – and those who are overwhelmed by emotions.

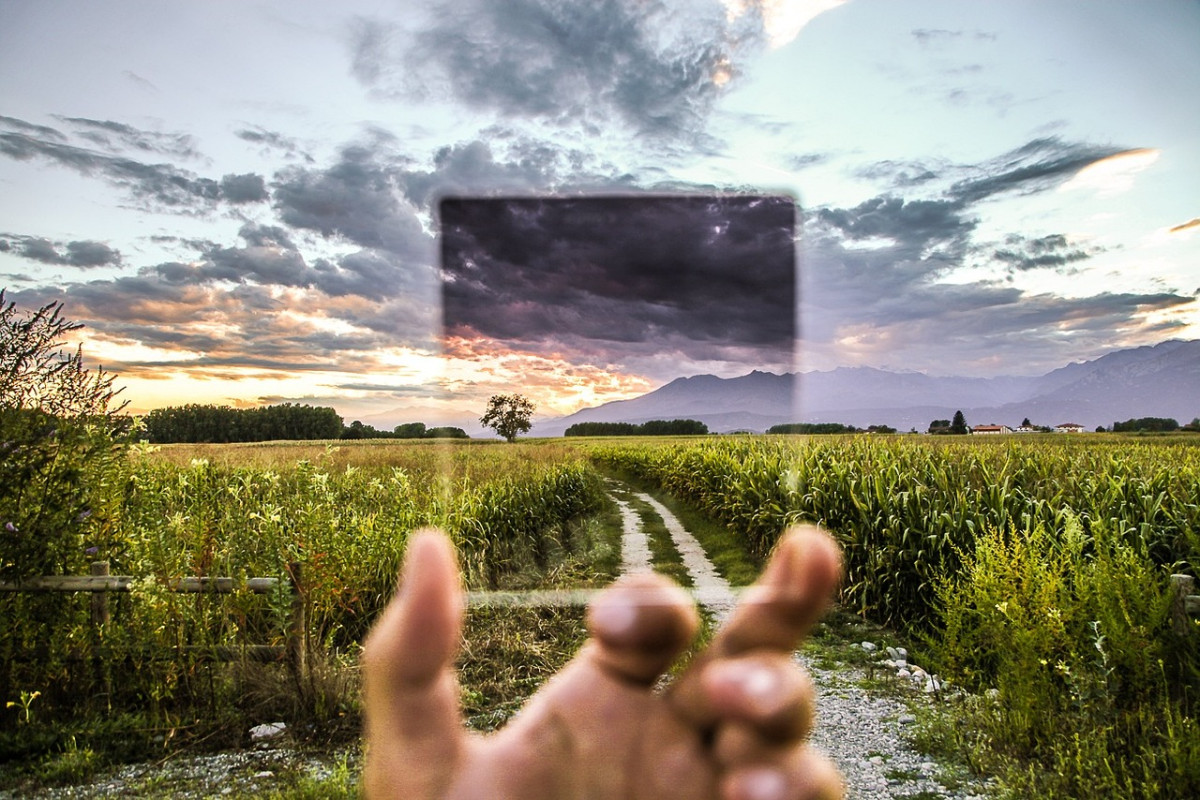

The Bigger Picture

Every investor knows the feeling: The market is falling, portfolios are deep in the red, and negative headlines dominate everywhere. It quickly feels like the world is ending. But instead of being swept away by fear, it helps to take a step back.

During crises, many forget that long-term trends in the stock market are usually positive. Economies grow, companies recover, and after every downturn comes an upturn. While some panic sell, others see buying opportunities.

Crashes Are Part of the System – and Part of Success

Looking back over the past decades:

2008 Financial Crisis: Banks collapsed, stocks plummeted – but those who held on later earned massive returns.

2020 COVID-19 Crash: The market lost 40% in just weeks, but within a year, many indices hit new all-time highs.

2022 Tech Sell-Off: Corrections and rising interest rates caused high-flyers to tumble, yet recovery followed.

Every crash felt existential for those experiencing it. But in the long run, it was always a phase that passed – and smart investors were rewarded.

Aktiokrat RiskGuard: Your Tool Against Emotional Decisions

Emotions are an investor’s worst enemy. Panic-selling or over-eager buying often lead to the worst decisions. This is where Aktiokrat RiskGuard helps:

✅ Objective risk assessment – Which companies are truly at risk?

✅ Avoid psychological pitfalls – Prevent panic selling through clear analysis.

✅ Correctly interpret crash signals – Know when a real crisis is starting versus when it’s just a market correction.

Conclusion: Crisis or Opportunity? You Decide!

There will always be periods when the stock market feels bad. But instead of getting lost in negative emotions, investors should recognize that every crisis also brings an opportunity.

🔹 Maintain a long-term perspective

🔹 Don’t sell out of fear – act with conviction

🔹 Use tools like Aktiokrat RiskGuard to invest rationally

Those who stay calm during tough times and make decisions with a clear head will ultimately be more successful than those driven by fear or greed.

Join the discussion in our forum: How do you handle emotional market phases?